Berufsbegleitendes FernstudiumBerufsbegleitendes StudiumBlock-ModellDuales StudiumFernstudiumHybridOnline-FernstudiumSelbststudiumTeilzeit StudiumVollzeitstudiumWeiterbildungintegriertes Auslandsstudium

Stipendien sind eine an Bedingungen geknüpfte Art der Studienfinanzierung während Förderprogramme Studierende durch andere Maßnahmen unterstützen. Hier erfahren Sie alles Wissenswerte zu den Programmen.

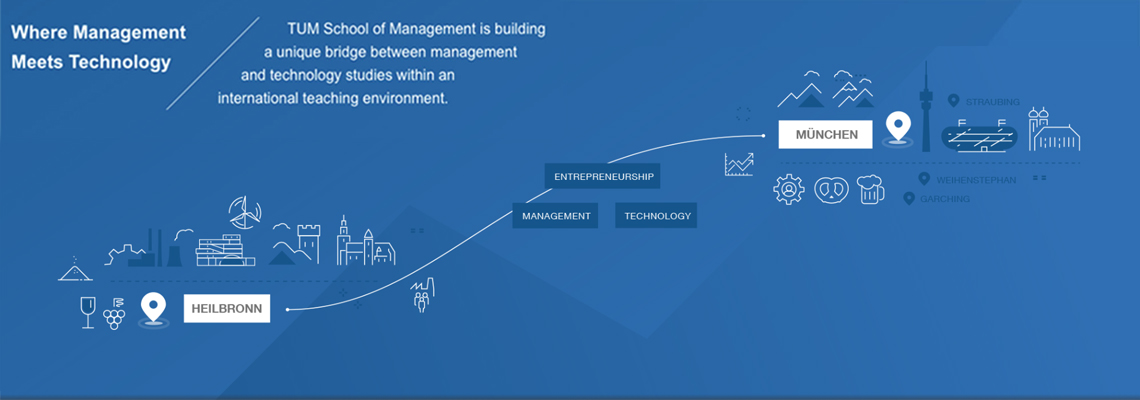

Der WiWi-Online Business School Guide gibt Ihnen wertvolle Informationen rund um das Studium an einer Business School für eine zielgerichtete Studienplanung: Bachelor, Master und PhD Programme, Aufnahmekriterien, Finanzierung, Akkreditierung und viele Themen mehr.

Die aktuelle Ausgabe des Business School Guide wird gefördert durch